The Bank of Canada has given their first rate update of 2022. The media has been putting out a lot of doom and gloom about interest rates in Canada lately so we want to clarify a few items along with provide the current update.

For the full update from the Bank of Canada: https://www.bankofcanada.ca/2022/01/fad-press-release-2022-01-26/

Key Points:

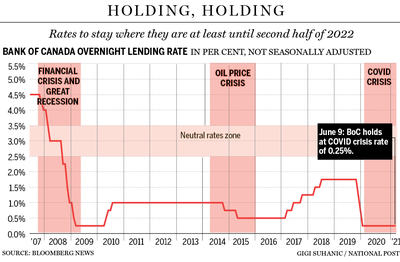

- Bank of Canada has maintained their overnight rate of .25% (No Change)

- Variable rate mortgage holders: your interest rate has not changed

- Higher inflation is expected to continue in the short term

- The bank of Canada will likely increase their overnight rate (So variable rates will increase) later this year

- Omicron is still top of mind for the Bank; however, they see it as being less severe than previous waves.

Fixed Rate update:

Fixed rates have continued to creep up over the holidays and are now close to pre-pandemic levels.

Our Thoughts:

We are still a big believer in a variable rate mortgage right now due to the large interest savings with the current variable/fixed rate difference. Variable rate mortgages also come with much smaller penalty and have more flexibility (Locking in/refinancing at little cost). Keep in mind that if you are in a variable rate mortgage you will likely see you rate increase at least a couple of times this year. The strategy we recommend is paying more than your minimum monthly payment if possible. This takes advantage of current low rates by paying off your mortgage quicker as well as insulates you from payment shock (Ie increased payments) if rates go up as you will already be paying higher than the minimum payments.

Have Questions? Please reach out to us anytime!